Dawn Aguiar, House Debtor/Deadbeat

Dawn Aguiar, House Debtor/DeadbeatMs. Aguiar should not be seeking a write-down in her mortgage principal. Houses might be selling for $450-500K in her neighborhood, but at the bottom, $300K might be the price. And if this economy unfolds into a full-blown meltdown, they won't be able to give these houses away.

Dawn, this video is for you:

THE HOUSING BUBBLE EXPLAINED ** SPECIAL SHEEP VIDEO!

2008-11-25: Homeowners say no help from lenders

Customers of Countrywide, Wachovia and other lenders describe the firms as uncooperative, ineffective and rude. Borrowers say they must navigate a maze of phone banks. They say lenders won't offer good deals."They're supposed to be getting people into fixed-rate loans they can afford, reducing their principal," Aguiar said. "That's not what I'm getting from Countrywide."

"Countrywide says it wants to help people restructure? That's baloney," said Dawn Aguiar, who bought her Fremont home for $587,000 in 2005. "They have not been helpful at all." She financed the purchase with $586,000 in Countrywide loans.

Homes in her neighborhood sell for $450,000 to $500,000. Her house is "under water" — worth less than the loan.

Aguiar said she often hears Countrywide and other lenders are aggressive in finding ways to redo loans.

"They're supposed to be getting people into fixed-rate loans they can afford, reducing their principal," Aguiar said. "That's not what I'm getting from Countrywide."

Her adjustable rate loan balance increases monthly. She's behind in her payments.

"One lady I spoke to was rude, she had a real attitude," Aguiar said. "She talked down to me like I was a deadbeat."

===============

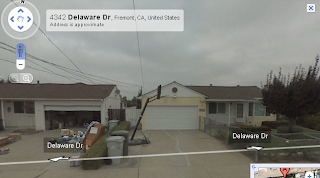

Ok, lets check out her house...

4343 Delaware Dr Fremont CA 94538

3 beds, 2.0 baths, 1,104 sq ft

Sale History

12/16/2005: $587,000

08/26/1998: $234,000

$587K for 1100 sq ft!!!

$533/sqft!!!

These are the idiots we're wasting tax dollars on. Lets do the math:

- assume 20% down

- $470K mortgage loan

Historical affordability guidelines are 3x gross earnings for loan amount. Lets use 3.5x...

$470K/3.5 = $134K

The Aguiar household must earn $134K, right?

(at 10% down, household income of $150K!, 0% down, $168K!)

5 comments:

She doesn't have to make $134k or $150k or even $168k. She only has to make enough to pay less than the interest on a 5 yr ARM that will reset in a year or two. At that point, she can just sell the house to someone else to wipe out what she owes, right? Unless the house is worth more than the mortgage...oops...

This speech ignited interest in exotic loan financing, and the chickens are coming home to roost:

February 23, 2004: Greenspan

American homeowners clearly like the certainty of fixed mortgage payments. This preference is in striking contrast to the situation in some other countries, where adjustable-rate mortgages are far more common and where efforts to introduce American-type fixed-rate mortgages generally have not been successful. Fixed-rate mortgages seem unduly expensive to households in other countries. One possible reason is that these mortgages effectively charge homeowners high fees for protection against rising interest rates and for the right to refinance.

American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage. To the degree that households are driven by fears of payment shocks but are willing to manage their own interest rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home.

My in-laws, flippers turned floppers, are now thinking to stop payments on their upside down house. Their reasoning is that they tried to re-work their loan, but the bank was uncooperative. However, their friends who have stopped paying, eventually were called by the pleading banks with offers to refinance.

ArtLatin,

Wow! Banks pleading to take less money. This is one messed up world we live in, and I can only see it ending badly. My only wish is that gold, silver, and some select commodities and stock do well. And if they do well, I hope I can help my family, if they need it.

Why in the world are people angry that banks won't live up to unsubstantiated rumors of throwing away free money? These people have moved beyond greedy and are approaching flat out malicious.

Post a Comment