Here are my concerns/predictions going into 2009. Similar concerns led me to exit the stock market last year, and I'm trying to position myself for '09, but it's difficult to find safety.

Here are my concerns/predictions going into 2009. Similar concerns led me to exit the stock market last year, and I'm trying to position myself for '09, but it's difficult to find safety.What am I missing?

Also, I added many links to '09 predictions.

- Enter 2009 in a RECESSION

- Credit Card Debt and Credit Contraction

- Alt-A, Prime ARM, Option ARM resets coming

- Increase in cost of borrowing money (eventually this must happen)

- Freddie Mac and Fannie Mae will be given unlimited access to the U.S. Treasury

- Continued House Foreclosures (6M-12M by 2012)

- House prices falling, and must still fall 50% in some areas

- College/University Costs (another bubble?)

- Retail Sector Collapse

- Commercial Real Estate Collapse

- Manufacturing is Falling

- Destruction of the United States’ domestic manufacturing capacity

- Rising Unemployment

- Rising Healthcare costs; medical care for unemployed; healthcare bubble?

- Tax Increases (talk has begun)

- Civil Unrest / Protests / Tax Revolution

- Increase in Crime

- Corporate Contraction

- Reduced State/Government Tax Revenue

- Existing US Debt is massive

- Capitalism is dead, they are looting the treasury

- State Debt and Municipal Bond Default

- Hedge Fund Implosion (unknown dollar amount); CDS Risk

- Rising Food Costs (deflation for other goods, but food is up)

- Weakening US Dollar leading to Devaluation? Collapse?

- Fed 'Quantitative Easing' (money dropped from helicopters)

- Rampant Inflation Possible (long-term)

- Intentional Devaluation of US Dollar

- US Dollar as the worlds reserve currency at risk; Russia and China announcing they no longer consider it the worlds reserve currency; G20 meeting in '09 will be interesting

- US Bond Market Collapse

- Bank Failure Risks

- Loss of Economic & Dollar Confidence

- US Markets Likely to Drop 25-50%

- Markets Crashing Around the World

- Foreign Currencies in Trouble (e.g. Ruble)

- Wars/Troops in Iraq and Afghanistan; billions spent every day

- Turmoil in Pakistan and India

- Iran Nuclear Capability

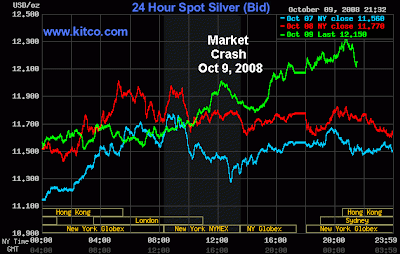

- Gold/Silver to rise (Gold ~$2000, Silver ~$30)

- In the not-too-distant future, 500 oz of silver will be able to buy the average house, and 1 oz of gold will be equivalent to 1 share of the DOW

Other Predictions:

Where We Are, Where We're Heading (2009) (Market Ticker)

Our 2009 Predictions (Roger Wiegand)

10 Predictions for 2009 (Jason Hamlin)

Top Trends Of 2009 (Gerald Celente)

10 Worst Real Estate Markets of 2009

8 really, really scary predictions (Fortune)

Outlook '09: Forget Good, Economy Is Bad Or Ugly

What will 2009 bring for Gold?

10 worst real-estate markets for 2009

Golddrivers 2009 - Bullish outlook for gold (Eric Hommelberg)

2009 forecasts in a nutshell (Peter Cooper)

Prospects for 2009 (Jim Klinge)

Time to break out the crystal ball (golfer_X)

Gold and Silver in 2009 (James Turk)

2009 Real Estate Forecast: Troubles Spread

Forecast for 2009 (James Howard Kunstler)

The Year Ahead: 2009, Part 1 (Glen Allport)

2008 Year Review and Outlook For 2009 (Peter Grandich)

Outlook for 2009 (Monty Guild)

Ten Things We Might Expect to See in 2009 (Jesse's Cafe)

Predictions for 2009 (Jim Otis)

25 Predictions for 2009 (One Salient Oversight)

California 2009 Economic and Housing Forecast (Dr. Housing Bubble)

2009: Managing The Shift From Deflation Back To Inflation

Forecast 2009: Deflation and Recession (John Mauldin)

Video/Audio Predictions:

Gerald Celente on GoldRadio - 12/23/2008

Marc Faber predicts economic disaster in 2009 part 1 of 2

60 Minutes: The Mortgage Meltdown - Coming ARM Resets

Analyst: One Third Of Banks Could Collapse In 2009

What is Gold Telling Us? (Oil/Gold Price Ratio is broken)

Marc Faber on CNBC - 12/29/2008

CNBC Healthcare Bubble Next to Collapse

Tech Outlook 2009

John Rubin - Gold 2009

Other Links:

‘Pay option’ mortgages could swell foreclosures (12/10/2008)

Fitch: Alt-A Mortgages Deteriorating More Rapidly than Expected (12/15/2008)

Option ARM: No one saw it Coming According to the Mainstream Media. The Alt-A and Pay Option ARM Tsunami Quickly Approaches. Charting the Option ARM and Alt-A Wave. (12/16/2008)

Quantitative Easing: FAIL (Denninger, 12/24/2008)

Russia Devalues Ruble for Third Time in Week (12/24/2008)

Bleak economic picture emerges from new data (12/24/2008)

Year Stained By Insolvency (12/26/2008)

The deflation that many analysts describe is actually a systemic liquidation that will be difficult to reverse, a necessary step by producing the critically important inflation. ... THE ENTIRE MORTGAGE INDUSTRY, COMPLETE WITH MILLIONS OF HOME MORTGAGES, AND PERHAPS COMMERCIAL MORTGAGES, WILL BE NATIONALIZED WITHIN THE NEXT 12 TO 18 MONTHS.

Dollar Devaluation To Fix The Great Recession (12/09/2008)

Ponzi Nation (12/26/2008)

Retail Sales Plummet (12/26/2008)

Consumers fall deeper into debt (12/23) Consumers, not PEOPLE.

U.S. Home Resales Fall (12/23/2008)

China to begin yuan-settlement trials (12/25/2008)

China to allow freer yuan trades (12/25/2008)

U.S. debt approaches insolvency (12/19/2008)

US urging calm over possible Pakistan troop moves (12/26/2008)

Retailers Brace for Major Change (12/23/2008)

Hospitals Ill from Bad Debt (12/27/2008)

Getting Excited about 2009

The Global Economic Crisis - Bad and Worsening

2008: A Year in Review, Part I (Daily Reckoning)

2008: A Year in Review, Part II

Is recession behind spike in bank robberies?

Economy Down, Theft Up

False Diagnosis of Deflation (Jim Willie)

Manufacturing index drops to 28-year low

Cash-poor states eager for a piece of Obama plan

44 States Face Huge Budget Shortfalls

U.S. governors seek $1 trillion federal assistance

California governor offers new budget fix plan

Is Social Security a Ponzi Scheme?

Late December Economic Rant -Roger Mason

How Deflation Creates Hyperinflation

*****Ten Major Threats Facing The Dollar in 2009*****

Dollar, Treasuries, Gold, Silver, Oil, Banks, Home Inventories/Delinquencies, Vacancies

Legislature to consider college tuition freeze

Can somebody point out the $300K pool? BWAHAHAHA

Can somebody point out the $300K pool? BWAHAHAHA

Billion Dollar Bailout Used For Parties at The Ritz Carlton

Billion Dollar Bailout Used For Parties at The Ritz Carlton

2008-05-15:

2008-05-15: